Record of All Transactions Affecting a Company

A chronological record of all economic events affecting a firm are recorded in a what. All accounts used to record the companys transactions.

How Transactions Affect The Balance Sheet

The records you need to keep depend on the tax and superannuation obligations of your business and the structure of your business sole trader partnership.

. Your journal keeps a record of all your business transactions tracking them in chronological order as they happen. For example if a company buys a computer for. Using supplies on hand Internal transactions uses supplies on hand.

A simplified form of a general ledger account with space at the top for the account title and two sides for recording debits and credits. You are legally required to keep records of all transactions relating to your tax and superannuation affairs as you start run sell change or close your business specifically. Accrual and Cash accounting are two ways in which any business transaction is recorded.

Adding new journal entries is called. Transaction record in accounting is defined as a business occurrence that has a monetary effect on the financial records of a firm. Analyzing source documents to determine the effects of transactions on the companys accounts.

That is why one of the key duties of accountants is to keep track of all company financial transactions by recording them into the companys accounting system or writing them down in the journal and then transferring the entries into the. Journalizing in accounting is the system by which all business transactions are recorded for your financial records. You must keep records of all transactions related to your businesss tax and superannuation affairs including records that support the information you include in your tax returns and reports.

Recording transactions is vital to a businesss financial statements and a key responsibility of the accounting department. After recording the business transaction in the Journal or special purpose Subsidiary Books the next step is to transfer the entries to the respective accounts in the Ledger. A good recordkeeping system includes a summary of your business transactions.

Balance Sheet The balance sheet is one of the three fundamental financial statements. A journal is a book where you record each business transaction shown on your supporting documents. A business transaction is first recorded in a journal also called a Book of Original Entry.

Any documents related to your businesss income and expenses. You may have to keep separate. Posting transactions to T-accounts involves.

What is a internal transaction. Any documents containing details of any election choice. External transactions purchases supplies from a vendor T-account.

Ledger is a book where all the transactions related to a particular account are collected at one place. Internal Transactions Events that affect the financial position of the company but do not include an exchange with a. Preparing a chronological record of all transactions affecting the company.

As a General Ledger GL records all of the transactions that affect a companys accounting elements such as Assets Liabilities Equity Expenses and Revenue it is the data source used to construct the Balance Sheet. Listing all accounts and their balances at a particular date to ensure that debits equal credits. Each entry is expressed in terms of equal debts and credits to the accounts affected by the transaction being recorded.

Determine the dual effect of business events on the accounting equation. A check register or cash disbursements journal is where you record all of the check and cash transactions your business has during an accounting period. Terms 1 2 Descriptions Record of all transactions affecting a company.

You can buy them at your local stationery or office supply store. Also remember that only those business transactions which concern money and can be expressed in monetary terms are recorded in the books of account. Types of Accounting Transactions based on Objective.

List of accounts and their balances. Special journals They record repetitive types of transactions eg. Having business records up-to-date and accurate is vital for every company regardless of its size or its business sector.

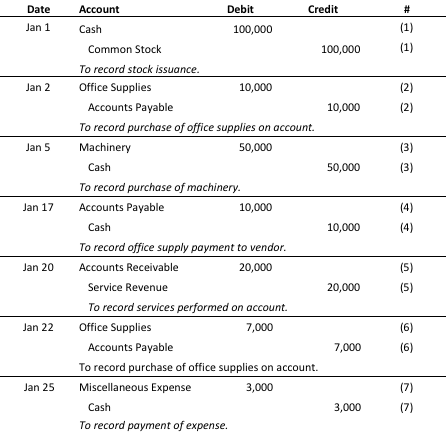

Record the transaction in a journal The journal provides a chronological record of all economic events affecting a firm. Depending on your businesss needs and preferences you may have a separate business check register. Using supplies on hand Internal transactions uses supplies on hand.

Learn the definition of a transaction understand the importance of. These are everyday transactions that keep the business running such as sales and purchases rent for office space advertisements and other expenses. Businesses use a check register to calculate a running balance of their checking account.

A chronological record of all transactions affecting a firm. The process of transferring the debit and credit information from the jounral to individual accounts in the general ledger. There are two types of accounting transactions based on objective namely business or non-business.

Transfer balances from the journal to the general ledger. Purchase of machine land or building sale to a customer in credit or cash etc. Overview of record-keeping rules for business.

Summary of the effects of all transactions related to a particular item over a period of time. A chronological record of all economic events affecting a firm are recorded in a journal When a company performs services for a customer and the customer agrees to pay for the services at a later date the transaction is recorded in which account. Business transactions are ordinarily summarized in books called journals and ledgers.

The Accounting Cycle Personal Finance Lab

Recording Accounting Transactions The Source Documents General Journal General Ledger Trial Balance

No comments for "Record of All Transactions Affecting a Company"

Post a Comment